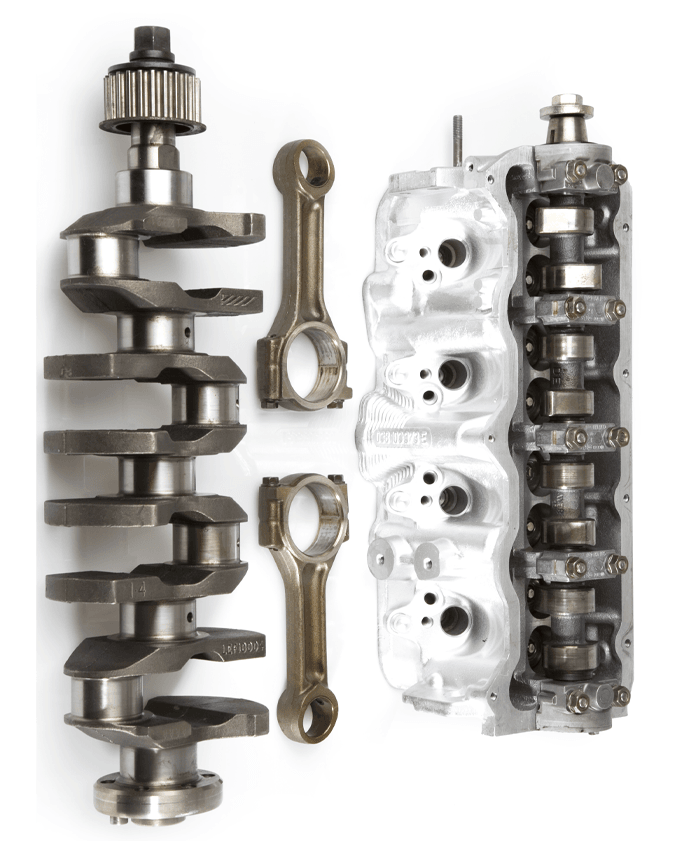

AUTO PARTS & ACCESSORIES MERCHANT ACCOUNTS

HIGH RISK MERCHANT ACCOUNTS FOR AUTO PARTS & ACCESSORIES.

FASTER APPROVALS. COMPETITIVE PRICING. BETTER SERVICE.

HIGH RISK MERCHANT ACCOUNTS FOR AUTO PARTS & ACCESSORIES.

FASTER APPROVALS. COMPETITIVE PRICING. BETTER SERVICE.

Cars are one of the most popular modes of transportation worldwide. However, cars also need a lot of upkeep. That’s why the automotive parts and accessories is a stable industry that does well in good times and bad. DigiPay Solutions has created an auto parts and accessories report with additional important information about setting up a merchant account, controlling chargebacks, managing risk, and keeping merchant accounts in good standing.

DigiPay Solutions is a recognized payment processing brand among auto parts and accessories companies. The company’s extensive network of partner banks, payment experts, and elite portfolio of tailored solutions has helped launch entrepreneurial start-ups and take enterprise organizations to the next level of corporate growth.

Thousands of merchants, from start-ups to enterprise-scale organizations, leverage DigiPay’s curated knowledge of high-risk payments to securely process millions of transactions across an array of vertical industries. DigiPay works closely with automotive parts and accessories partners, providing tailored solutions and timely advice to national and regional service providers, while helping them maintain the highest standards of banking and payment card industry compliance.

DigiPay’s team of experts, combined with our partners’ proven record of successful auto parts and accessories businesses, can facilitate successful new company launches and help existing businesses grow and scale.

According to IbisWorld, the automotive parts and accessories industry is a $5 billion-dollar industry. The industry has grown by 12.9% from 2011-2016. The automotive parts and accessories sales industry is expected to continue to grow over the next five years as more products become available online.

Automotive parts and accessories providers are categorized by SIC Codes, NAICS Codes and Visa Merchant Category Codes (MCC) to comply with payment card industry requirements.

Proper classification is vitally important to prevent funds from being held in reserve for misrepresentation. The auto parts and accessories industry has a specific NAICS code which is grouped under “Motor Vehicle and Motor Vehicle Parts and Supplies Wholesalers” in NAICS or MCC codes, and can be classified according to the nature and focus of services. The following are some examples:

SIC 5013: Motor Vehicle Supplies and New Parts

SIC 5014: Tires and Tubes

SIC 5015: Motor Vehicle Parts, Used

SIC 5531: Auto & Home Supply Stores

NAICS 42111: Automobile and Other Motor Vehicle Wholesalers

NAICS 42112: Motor Vehicle Supplies and New Parts Wholesalers

NAICS 42113: Tire and Tube Wholesalers

NAICS 42114: Motor Vehicle Parts (used) Wholesalers

NAICS 441310: Automotive Parts and Accessories Stores

MCC 5533: Automotive Parts and Accessories Stores

Additional information on Visa MCC can be found in this downloadable guide.

Top performing companies in the automotive and accessories industry are seeing more success by offering the ability to buy auto parts and accessories online. By providing a way for customers to purchase their own parts, you can expect your company to gain increased sales.

Competing against large market dominators such as NAPA, O-Reilly, or Autozone is like David going up against Goliath. This is why many auto parts entrepreneurs have found success by specializing in niche markets such as performance racing, collector cars, or speciality cars. These niches are smaller than general-purpose auto parts stores, but the profit margins are higher and the customers tend to be very loyal. These types of specialty sales also lend themselves well to selling online where merchants have an expanded customer base.

Here are a few leading companies in the space:

National Automotive Parts Association, Inc., also known as NAPA Auto Parts, distributes auto parts and accessories, and tools, equipment, and supplies. It offers air conditioning systems, belts and hoses, brake systems, drivetrain products, electrical systems, engine kits, engine parts and gaskets, exhaust systems, fuel and emission systems, heating and cooling products, ignition parts and filters, kit programs, repair manuals and promotional items, and steering and suspension products; relays, sensors, and switches; and vision, safety, and miscellaneous interior/exterior parts. The company also provides cable and chain products, fasteners and hardware products, fittings and hose products, paint and body products, and shop supplies. In addition, it offers batteries, race car transporters, motor oils, and Bluetooth earbuds; and reversible wrench sets, chrome vanadium alloy sets, lithium mobile jump starters, and car readers. Further, the company provides education and training, and other professional services. It serves auto service professionals, do-it-yourselfers, and drivers. It also sells products through an online store. The company was founded in 1925 and is based in Atlanta, Georgia. It has operations in Canada, Mexico, Australia, and New Zealand. National Automotive Parts Association, Inc. operates as a subsidiary of Genuine Parts Company.

O’Reilly Automotive, Inc. is one of the largest specialty retailers of automotive aftermarket parts, tools, supplies, equipment and accessories in the United States, serving both the do-it-yourself and professional service provider markets. Founded in 1957 by the O’Reilly family, the Company operated 3,740 stores in 39 states as of December 31, 2011.

Located in Bermuda, Bacardi used to deal in only rum. Since 1993, their company merged with Martini & Rossi to create many, many more of the liquors and spirits that we know and love today. Some of their most popular brands include Grey Goose, Bombay Sapphire, Bacardi, ad Dewars.

Bosch is one of the top companies in the automotive world. They manufacture and market original equipment and products for the North American market. They are also the original equipment and innovation leader in the automotive industry.

With your great brand story and DigiPay Solutions as your processing partner, there’s no limit to how far you can scale your company. DigiPay’s diverse, extended family of liquor sale services process anywhere from $20,000 to millions in monthly revenue.

Interested in learning more about Publicly Traded Auto Parts & Auto Part Accessories Companies listed on Major U.S. Exchanges?

Automotive parts and accessories companies provide a way for consumers to find new parts for their vehicles that need replacing. By providing consumers with the products they need, they can then replace these items in the cars themselves without needing to go to a mechanic to do it for them. By offering auto parts and accessories online, companies can also increase their sales by finding consumers who are searching for these products on the internet.

Automotive parts and accessories companies are higher in demand now than ever before.

According to Zion Market Research, the automotive and auto parts industry saw certain opportunities in the following areas:

The biggest challenge within the auto parts and accessories industry is getting started. Despite the increasing rate of the auto parts and accessories industry, many of these companies have been in business for decades and are recognized brands. This can be challenging for startup businesses and it is why many choose to focus on a more narrow niche market such as racing or collector car parts.

The first step in enabling commerce is to establish a merchant account. The automotive parts and accessories industry is classified as higher-risk, making some businesses ineligible for merchant accounts at some sponsoring banks. DigiPay’s expanded network of banking relationships accepts the auto parts category and provides competitive rates, terms and conditions.

Automotive parts and accessories companies may find it advantageous to work with processing partners who are familiar with their industry, jargon and common business practices. Payment processing sales representatives who are not familiar with automotive parts and accessories lingo and practices may be less effective at managing relationships due to their learning curves. Automotive parts and accessories companies work with knowledgeable processing partners, they can save time and money, improve efficiencies and attract and retain more customers and followers.

Some banks are not willing to accept automotive businesses as the industry can have higher-than-average number of chargebacks. An entrepreneurial start-up company that has created an automotive parts and accessories website may not anticipate the risks involved in working with consumers whose sometimes unrealistic expectations about using an automotive parts and accessories service. Given that many banks may not understand the automotive parts and accessories industry and that many people desire these products, it may be difficult for them to find a bank that understands the process.

Automotive parts have also been a target for fraudsters as the parts have high resale value. As EMV chip cards are now widely deployed fraud has moved online.

Here are some risks commonly associated with the auto parts industry:

Automotive parts and accessories companies in the early stages of setting up their businesses may not have the appropriate levels of customer service support to deal with consumer complaints and inquiries. Consumers who are unable to communicate their concerns to merchants are at increased risk of turning to payment card issuers for refunds and chargebacks.

Yes, at DigiPay, automotive parts and accessories are in our DNA. Our financial services specialists are familiar with the industry’s unique framework and diversified categories, business models, SIC and NAICS codes and VISA MCC. We underwrite our merchants before sending their applications to our sponsor bank.

Once new merchants establish credibility and trust with DigiPay banking partners, they receive personalized attention and ongoing risk management from DigiPay’s team of payment specialists. This personalized service, coupled with the sheer volume of transactions we process through multiple banks, ensures our merchants receive the highest level of service and support.

Choosing the right payment processing partner is critical, because without the ability to accept payments, merchants are out of business. DigiPay’s merchant onboarding process combines sophisticated technology with human oversight. Experienced underwriters who understand the automotive parts and accessories industry, and have expertise in payment card brand and banking industry compliance, bring a refreshingly holistic approach to new account set-ups.

Whether you’re interacting with customers in person, your interactive website, or mobile app, DigiPay Solutions will give every merchant the attention and resources they deserve and a one-stop shop for processing solutions. The automotive parts and accessories industry is growing and DigiPay can accelerate that growth. The first order of business is eliminating any barriers to progress. Look no further than DigiPay Solutions, where getting a merchant account will open doors to a bright and prosperous future.

Because of the potential higher risk associated with auto parts companies, more due diligence is required during the new merchant onboarding process. This means underwriters need to review a range of documents to assure the business is compliant, financially sound, and a good credit risk. DigiPay is unique because we underwrite merchants in-house before we submit their applications to the bank. Because our team of underwriters is experienced in high-risk, your business is presented to the bank with all required documents and full disclosure, to engender trust and stability.

Presenting your business in the best possible light from point of first contact is important because merchant accounts are essentially a line of credit from a processor. Because high-risk merchants have higher chargeback ratios and regulatory exposure, financial institutions are concerned they may violate card brand rules, laws and regulations. Complaints to the FTC against a merchant create liability not only for merchants, but can also hold processors accountable under Know Your Customer (KYC) regulations.

DigiPay’s in-house team of underwriters and risk managers have curated knowledge in all areas of high risk. We are best qualified to guide you through the process efficiently and painlessly while helping to present your business to increase approval and gain credibility.

Once an automotive parts and accessories company is approved, payment processors set monthly processing limits for new businesses, typically between $25,000 and $50,000 per month, for the first three-to-six-months. This gives processors time to develop a customer risk profile by evaluating payment flows, average ticket sizes, processing levels and chargeback ratios.

Automotive parts and accessories companies that maintain a stable, consistent performance throughout their initial trial periods can usually increase their processing limits. DigiPay’s risk management team works with merchants and sponsoring banks to shorten trial periods and raise processing limits.

Maintaining a low chargeback ratio is key to maintaining a healthy merchant account. When chargebacks exceed card brand maximums, your merchant account is at risk of being shut down. If a merchant category has consistently excessive chargebacks, banks will sometimes shut down an entire vertical industry. For this reason, it is critical for high risk verticals to self-regulate and work collaboratively to establish industry best practices.

Chargebacks can be an emotionally charged issue for many merchants, but with the right systems in place, managing and defending against them can be a routine part of any merchant’s business. DigiPay Solutions’ team of Chargeback Champions works with business partners to identify the root causes of chargebacks, proactively avoid them whenever possible and effectively address each chargeback and retrieval request.

Chargebacks happen for many reasons and DigiPay’s elite team of Chargeback Champions are expert at analyzing why. Our proactive approach includes:

Keeping track of your Transaction Chargeback Ratio as well as your Volume Chargeback Ratio is critical because this is what Visa, Mastercard and payment processors monitor. Payment processors with high chargeback ratios in their merchant portfolios can trigger unannounced audits by Visa or Mastercard. For this reason, DigiPay, powered by TranZlytics, closely monitors chargeback and refund ratios, reacting quickly to spikes in activity. Excessive refunds, frequently the result of alerts, can be a sign of fraud or poor business practices, information the card brands and banks may consider when assessing risk.

The formulas shown below use simple math to derive Transaction Chargeback, Volume Chargeback and Refund Ratios:

Add total monthly number of chargebacks and divide by total monthly number of transaction. For example – if during a month you processed 500 sales, and there were 10 chargebacks, your chargeback ratio would equal 10/500, or 2.00%.

Add total monthly dollar amount of all chargebacks and divide by the total monthly sales volume.

For example – if during a month, you processed 500k in sales, and your chargebacks were 10k, your chargeback ratio would equal 10/500, or 2.00%.

Add total monthly number of refunds and divide by total monthly number of transactions.

For example – if during a month you processed 500 sales, and there were 10 refunds, your refund ratio would equal 10/500, or 2.00%.

Add total monthly dollar amount of all refunds and divide by the total monthly sales volume.

For example – if during a month, you processed 500k in sales, and your refunds were 10k, your refund ratio would equal 10/500, or 2.00%.

It is important not to ignore chargebacks, because win/loss ratios matter. Visa and Mastercard can impose penalties and fines in the tens of thousands on payment processors and their sponsoring banks for continuing to process transactions for merchants that exceed the permissible 2 percent chargeback ratio. Non-compliant processors and banks may also be subjected to further scrutiny and potential shut-down by card brands and regulators.

Here are some recommended ways to maintain low chargeback and refund volume ratios:

Merchants can handle chargebacks in-house or outsource to a Chargeback Mitigation Specialist. The following companies are experienced in identifying all forms of fraud, including friendly fraud:

*DigiPay Preferred Provider

Automotive Parts and Accessories providers rely on ecommerce and Mail Order/Telephone Order (MOTO) sales to scale their businesses. Credit card payments transacted online or by phone are called Card Not Present (CNP) transactions. Online CNP transactions involve credit card gateways that transmit payments from merchants to their payment processors.

Following is a list of recommended attributes of payment gateways that address the unique requirements of automotive parts and accessories industries:

Some automotive parts and accessories companies may need multiple merchant accounts to support their diversified array of offerings. Gateways should ideally be able to manage multiple merchant I.D.s organized under one master MID relationship.

Payment gateways need to seamlessly integrate into CRMs, POS systems, third-party software, and ecommerce shopping carts to facilitate all forms of online, MOTO and in-store commerce.

Automotive parts and accessories companies need access to a variety of real-time reports and transaction data to grow and scale their businesses and manage chargebacks and refunds.

In addition to enhanced reporting, automotive parts and accessories stores need secure access to transaction data from anywhere they happen to be working, with built-in permission levels to facilitate all levels of employees and management.

Payment gateways must comply with the Payment Card Industry Data Security Standard (PCI DSS). Ask your gateway provider if they are PCI DSS compliant and verify their certificate annually. Automotive parts and accessories businesses also need a gateway with a data vault for tokenization of credit card numbers and encryption of customer personally identifiable information (PII).

Tokenization replaces a Primary Account Number (PAN) with a randomly generated set of numbers and records this in the data vault. This is to prevent hackers from accessing customer data. By storing PII and PAN in a highly secure, offsite location merchants shift their liability to the gateway provider. Encryption and tokenization keep your customer’s information safe while allowing merchants access to the data for future transactions.

TranZlytics Gateway:

Choosing the right gateway provider is critical for high-risk merchants and their processors. DigiPay’s chosen gateway is TranZlytics. TranZlytics offers high risk merchants a Gateway and HUB built from the ground up for high-risk and CNP merchants. The solution includes transaction analytics and fraud prevention and built-in advanced chargeback management.

TranZlytics also offers advanced real-time reporting for faster and better use of CRM data.

Payment descriptors are registered with a Chargeback Alerts program; re-presentments are pre-integrated with the gateway.

With a single HUB for transaction management and an expert risk management team to monitor your data, you can focus on what you do best, growing your business. Think of Tranzlytics as an online and mobile company Payment HUB with the IQ of Einstein and the memory of an elephant.

The automotive parts and accessories industry has become a worldwide phenomenon that is only continuing to grow. DigiPay is excited to play a supporting role when it comes to the growth of automotive parts and accessories. Our extended family of automotive parts and accessories businesses, with vastly different models and product sets, are equally committed to optimal results, performance metrics and profitability. Some offer subscription programs; others provide mobile apps. All want affordable and easy high-risk payment card processing, which is our specialty.

Mike Ackerman

Co-Founder, CEO, DigiPay Solutions

Annual conferences and events provide automotive parts and accessories businesses with networking and educational opportunities. Here are some examples:

Oct. 30-Nov. 1, 2018. AAPEX 2018 Las Vegas, Nevada. Come to this event to learn all about new and exciting products within the automotive and accessories industry! Over 2,200 exhibitors, 5,000 booths, and 44,000 targeted buyers will be attending this event! Not to mention that over 158,000 automotive professionals from over 140 countries will be attending this event as well. Come and join for this fantastic networking opportunity!

Thank you for taking the time to review this compendium to learn about available opportunities and solutions in the automotive parts and accessories industry. We look forward to welcoming you to our growing merchant community.

Our online application takes minutes to complete. Once approved, our relationship managers will help you personalize your business management portal and leverage our full complement of secure payment gateway and chargeback management tools. They’ll help provision your processing account, ecommerce website and POS systems in brick-and-mortar stores.

DigiPay will also make it easy for your customers to find you, by helping you create an engaging online and in-store presence and seamless customer checkout experience. Take your automotive parts and accessories business to the next level today at digipayinc.com.