CREDIT & COLLECTIONS

HIGH RISK MERCHANT ACCOUNTS FOR CREDIT & COLLECTIONS COMPANIES.

FASTER APPROVALS. COMPETITIVE PRICING. BETTER SERVICE.

HIGH RISK MERCHANT ACCOUNTS FOR CREDIT & COLLECTIONS COMPANIES.

FASTER APPROVALS. COMPETITIVE PRICING. BETTER SERVICE.

Third-party debt collectors, acting on behalf of creditors to obtain past-due receivables, play a vital role in the credit-based ecosystem. The collection industry employs thousands of collection professionals who collect on past-due accounts and recover billions in delinquent debt each year. U.S. debt collection agencies recover more than $50 billion annually, mostly from consumers. Debt recovery helps to reduce costs and tax burdens related to credit delinquencies and defaults.

DigiPay Solutions has created a “Debt Collection Industry Primer” with important information about setting up a merchant account, controlling chargebacks, managing risk and keeping merchant accounts in good standing.

DigiPay Solutions is a recognized payment processing brand among collection service providers. The company’s extensive network of partner banks, payment experts and elite portfolio of tailored solutions has helped launch entrepreneurial start-ups and take enterprise organizations to the next level of corporate growth.

Thousands of merchants, from start-ups to enterprise-scale organizations, leverage DigiPay’s curated knowledge of high-risk payments to securely process hundreds of millions across an array of vertical industries. DigiPay works closely with debt collection partners, providing tailored solutions and timely advice to national and regional service providers, and helping them maintain the highest standards of banking and payment card industry compliance.

DigiPay’s team of experts, combined with our partners’ proven record of successful debt collection services, can facilitate successful new company launches and help existing businesses grow and scale.

U.S. debt collection agencies recover more than $50 billion annually, mostly from consumers. Debt recovery contributes to the fiscal health of government and private sector organizations, improving local and national economies by recovering debt, providing employment and generating taxable revenue.

An international white paper by Josh Adams, PhD, Director of Research at ACA International, published January 2016, found $12.07 trillion in outstanding consumer debt in Q3 2015, with $672 billion in delinquent debt. Recovering delinquent debt benefits both lenders and consumers, Adams stated. “For lenders, the recovery of these outstanding debts allows them to keep costs down, maintain competitive prices in their local markets, and remain financially solvent,” Adams wrote. “For consumers, when debts have been sent to collections, there is often the opportunity to negotiate the total outstanding balance, pay a discounted price on the initial balance, or develop a payment plan with the collection agency as a mediator (ACA, 2014).”

Adams further noted that third-party collection companies returned $44.9 billion to creditors in 2013, representing an average savings of $389 per household, as businesses were not compelled to compensate for lost capital through increased prices (ACA, 2014). A full copy of the report is available here.

Debt collection consultants and service providers are categorized by SIC Code, NAICS Code and Visa Merchant Category Code (MCC) to comply with payment card industry requirements. Proper classification is vitally important to prevent funds from being held in reserve for misrepresentation.

SIC Code 7322: Adjustment and Collection Services

NAICS Code 561440: Collection agencies: Establishments engaged in collecting payments for claims and remitting payments collected to their clients provide the following services:

NAICS Code 561491: Repossession Services: Establishments engaged in repossessing tangible assets are classified as repossession services.

NAICS Code 522298: Non-depository Credit Intermediation: Establishments that provide financing to others by factoring accounts receivables by assuming risk of collection and credit losses.

As a rule, in-house collection activities are classified in the industry of the primary activity. For example, a collector working for a manufacturer would be grouped in the manufacturing sector.

MCC Codes: Of note, to date, Debt Collection does not have a specific MCC code and can be classified under different general industry codes, depending on the nature and focus of services.

Additional information on Visa MCC can be found in this downloadable guide.

Debt collection companies range from independent specialists to enterprise-scale organizations, providing abundant choices of providers and programs focused on improving financial health.

Here are some leading companies in the space:

San Diego-Calif.-based Encore Capital Group is a certified professional receivables company that operates in 11 countries. The company’s subsidiaries buy portfolios of consumer receivables from financial institutions, utility providers and municipalities and work with consumers to restore their financial health and repay obligations.

PRA Group, Inc. or PRA, is a publicly traded debt buyer based in Norfolk, Virginia. PRA was listed in the Federal Trade Commission’s “Report on the Debt Buying Industry” as one of the largest debt buyers in the US.

With your great brand story and DigiPay Solutions as your processing partner, there’s no limit to how far you can scale your company. DigiPay’s diverse, extended family of debt collection professionals process anywhere from $20,000 to millions in monthly revenue.

Interested in learning more about Publicly Traded Debt Collection & Credit Repair Companies listed on Major U.S. Exchanges?

Collection firms and debt buyers specialize in different types of debt, which may include credit card, student loan and healthcare expenses. Certain types of debt are subject to regulatory limits that require credentialing and specialization. For example, medical debt collectors must comply with privacy requirements. Methods used to collect debts with an average size of a few hundred dollars differ from those used to collect debts with an average size of several thousand dollars.

Approximately 30 million Americans had debts in some form of collection in 2013, and two in ten consumers have more than 90-day account delinquencies, according to CFPB estimates. Delinquent debt is typically collected by credit issuers, but many debts are transferred to third-party debt collectors that attempt to collect the debt on a contingency basis, or sell the debt outright to debt buyers, which collect in their own name.

Successful collectors bring a consultative focus to each discovery process and situation, helping consumers articulate their concerns and working with them to resolve issues. Numerous consumers have reported that working with a professional debt collector has helped them reduce debt burdens, interest rates and monthly payments and put them on a path to financial recovery.

The debt collection industry is a lucrative but volatile business. IBISWorld attributes the industry’s economic peaks and valleys to the rise and fall of consumer debt and default levels. For example, revenue surged with increased default rates in 2011 and 2012, then fell in 2013, as consumer debt decreased and the Consumer Financial Protection Bureau (CFPB) increased industry oversight.

The collection industry is also subject to scrupulous state and federal oversight. The Consumer Financial Protection Bureau (CFPB) has frequently accused debt collection companies of using coercive and manipulative tactics and disrespectful behavior. “Many people get into debt because they can’t afford to make monthly debt payments on top of paying for daily living expenses,” states the CFPB website. “If you’re not sure of the best way to handle your debt, a credit counselor can also help you explore your options.”

In a recent court action, CFPB accused Encore Capital Group and Portfolio Recovery Associates Inc. of misleading and harassing consumers, which led to a large settlement against the two industry leaders. Under the terms of the CFPB settlement, Encore has agreed to pay up to $42 million in consumer refunds plus a $10 million penalty, and to cease and desist from collecting more than $125 million worth of debts. PRA will pay $19 million in consumer refunds plus an $8 million penalty, and has agreed to stop collecting on over $3 million worth of debts. The companies are also expressly forbidden to resell debt to third parties.

ACA International notes that more than one billion consumer contacts are made each year by the debt collection industry, which is highly regulated by federal and state law to protect consumers’ rights. “As a result, legitimate debt collectors are focused on

Establishing a merchant account to process payments is the first step in enabling commerce. Debt collection is classified as a high-risk business, which means industry service providers are ineligible to apply for merchant accounts at numerous sponsoring banks. DigiPay’s expanded network of banking relationships accepts the debt collection business category and provides competitive rates, terms and conditions.

Debt collection practitioners find it advantageous to work with processing partners who are familiar with their industry, jargon and common business practices. Payment processing sales representatives who are not familiar with non-traditional forms of finance may be less effective at managing relationships, due to their learning curves. When debt collection companies work with knowledgeable processing partners, they can save time and money, improve efficiencies and attract and retain more customers and followers.

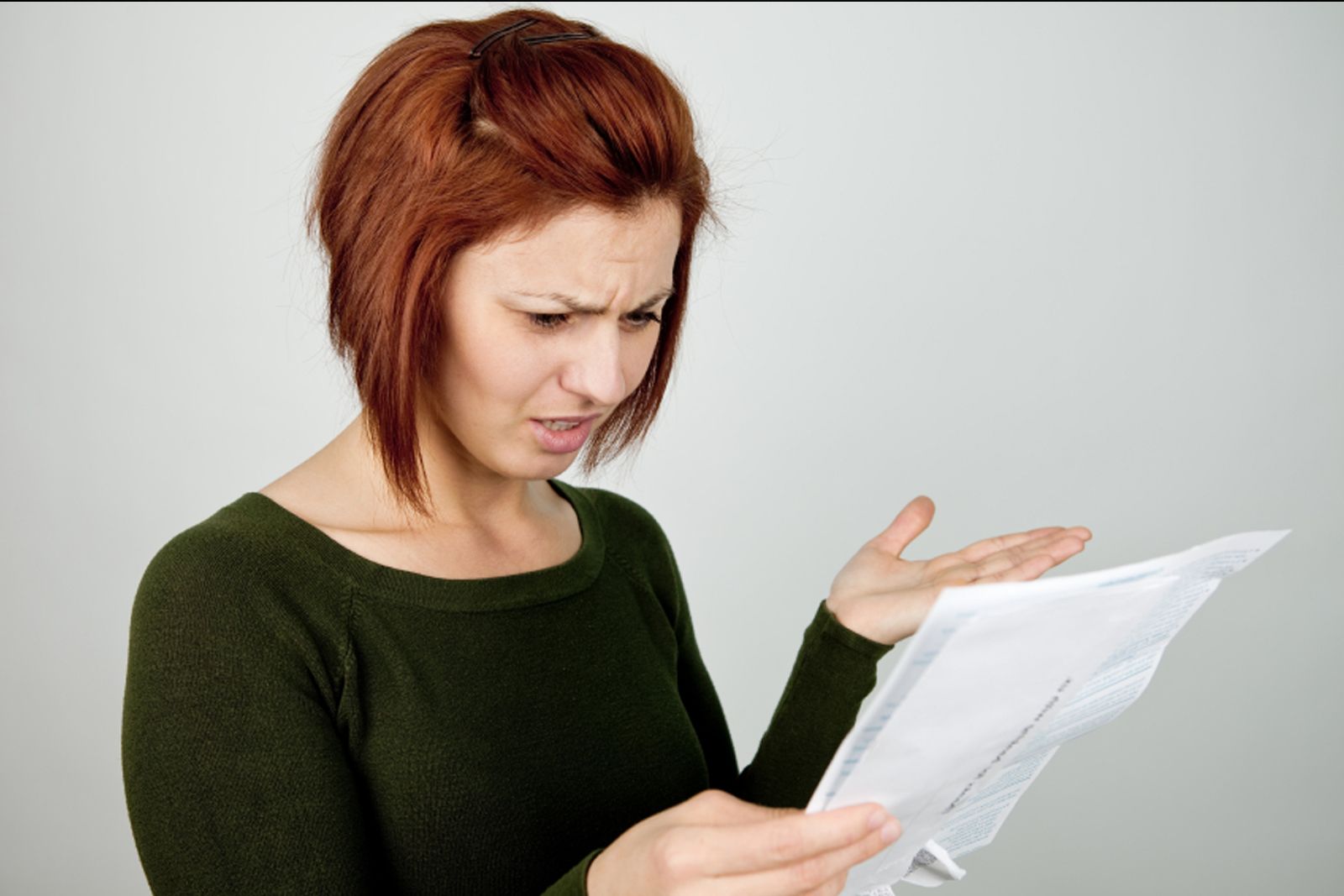

Many banks will not accept debt collection merchants due to the industry’s higher-than-average chargeback ratio. Collection agencies, especially entrepreneurial start-ups, may be unfamiliar with related risks of working with consumers whose high debt ratios and credit challenges increase the likelihood that they will default on a payment plan, file for bankruptcy or initiate chargebacks on recurring payments due to their inability to pay or misunderstanding of terms and conditions. Clients, who work with collectors to structure a repayment schedule, may not understand the consequences of non-compliance with a repayment plan.

Here are some risks commonly associated with professional debt collection:

Consumers who opt in to a repayment plan with automatic monthly payments may forget that their credit card will automatically be billed every month. They will then dispute the charge that appears on their credit card statement. Many card issuing banks require consumers to contact the merchant before they process a chargeback request.

Consumers may complain that collectors called before or after business hours or were discourteous. They do not have to prove the representative was disrespectful. A simple complaint about a debt collection specialist can prompt regulatory agencies to launch an investigation, creating additional exposure and negative publicity for debt collectors.

Collection agency start-ups in the early stages of setting up their businesses may not have appropriate customer service support to deal with consumer complaints and inquiries. Consumers who are unable to communicate their concerns to merchants are more likely to turn to their payment card issuers for refunds and chargebacks.

Yes, at DigiPay debt collection is in our DNA. As financial services specialists, we are familiar with the industry’s unique framework and diversity of categories, business models, SIC and NAIC codes and VISA MCC. We underwrite our merchants before sending their applications to our sponsor bank.

Once new merchants establish credibility and trust with DigiPay banking partners, they receive personalized attention and ongoing risk management from DigiPay’s team of payment specialists. This personalized service, coupled with the sheer volume of transactions we process through multiple banks, ensures our merchants receive the highest level of service and support.

Choosing the right payment processing partner is critical, because without the ability to accept payments, merchants are out of business. DigiPay’s merchant onboarding process combines sophisticated technology with human oversight. Experienced underwriters who understand the credit and collection industry, and have expertise in payment card brand and banking industry compliance, bring a refreshingly holistic approach to new account set-ups.

The collection industry is diversifying and growing and DigiPay can accelerate that growth, by giving debt collection merchants the attention and resources they deserve and a one-stop shop for processing solutions. The first order of business is eliminating any barriers to progress. Look no further than DigiPay Solutions, where getting a merchant account will open doors to a bright and prosperous future.

Because of the higher risk associated with debt collection, more due diligence is required during the new merchant onboarding process. This means underwriters need to review a range of documents to assure the business is compliant, financially sound, and a good credit risk. DigiPay is unique because we underwrite merchants in-house before we submit their applications to the bank. Because our team of underwriters is experienced in high-risk, your business is presented to the bank with all required documents and full disclosure, to engender trust and stability.

Presenting your business in the best possible light from point of first contact is important because merchant accounts are essentially a line of credit from a processor. Because high-risk merchants have higher chargeback ratios and regulatory exposure, financial institutions are concerned they may violate card brand rules, laws and regulations. Complaints to the FDA and the FTC against a merchant create liability not only for merchants, but can also hold processors accountable under Know Your Customer (KYC) regulations.

DigiPay’s in-house team of underwriters and risk managers have curated knowledge in all areas of high risk. We are best qualified to guide you through the process efficiently and painlessly while helping to present your business to increase approval and gain credibility.

Once a high-risk collection merchant account is approved, payment processors set monthly processing limits, typically between $10,000 and $30,000 per month, for the first three-to-six-months. This gives processors time to develop a customer risk profile by evaluating payment flows, average ticket sizes, processing levels and chargeback ratios.

Collection companies that maintain a stable, consistent performance throughout their initial trial periods can usually increase their processing limits. DigiPay’s risk management team works with merchants and sponsoring banks to shorten trial periods and raise processing limits.

Maintaining a low chargeback ratio is key to maintaining a healthy merchant account. When chargebacks exceed card brand maximums, your merchant account is at risk of being shut down. If a merchant category has consistently excessive chargebacks, banks will sometimes shut down an entire vertical industry. For this reason, it is critical for high risk verticals to self-regulate and work collaboratively to establish industry best practices.

DigiPay brings a deep level of understanding and expertise when it comes to chargeback management. Keep reading for advice from our industry veterans.

Keeping track of your Transaction Chargeback Ratio as well as your Volume Chargeback Ratio is critical because this is what Visa, Mastercard and payment processors monitor. Payment processors with high chargeback ratios in their merchant portfolios can trigger unannounced audits by Visa or Mastercard. For this reason, DigiPay, powered by TranZlytics, closely monitors chargeback and refund ratios, reacting quickly to spikes in activity. Excessive refunds, frequently the result of alerts, can be a sign of fraud or poor business practices, information the card brands and banks may consider when assessing risk.

The formulas shown below use simple math to derive Transaction Chargeback, Volume Chargeback and Refund Ratios:

Add total monthly number of chargebacks and divide by total monthly number of transaction. For example – if during a month you processed 500 sales, and there were 10 chargebacks, your chargeback ratio would equal 10/500, or 2.00%.

Add total monthly dollar amount of all chargebacks and divide by the total monthly sales volume.

For example – if during a month, you processed 500k in sales, and your chargebacks were 10k, your chargeback ratio would equal 10/500, or 2.00%.

Add total monthly number of refunds and divide by total monthly number of transactions.

For example – if during a month you processed 500 sales, and there were 10 refunds, your refund ratio would equal 10/500, or 2.00%.

Add total monthly dollar amount of all refunds and divide by the total monthly sales volume.

For example – if during a month, you processed 500k in sales, and your refunds were 10k, your refund ratio would equal 10/500, or 2.00%.

It is important not to ignore chargebacks, because win/loss ratios matter. Visa and Mastercard can impose penalties and fines in the tens of thousands on payment processors and their sponsoring banks for continuing to process transactions for merchants that exceed the permissible 2 percent chargeback ratio. Non-compliant processors and banks may also be subjected to further scrutiny and potential shut-down by card brands and regulators.

Here are some recommended ways to maintain low chargeback and refund volume ratios:

Merchants can handle chargebacks in-house or outsource to a Chargeback Mitigation Specialist. The following companies are experienced in identifying all forms of fraud, including friendly fraud. They will investigate chargeback claims and retrieval requests on behalf of merchants:

Many debt recovery and collection merchants rely on eCommerce and Mail Order/Telephone Order (MOTO) sales to scale their businesses. Credit card payments transacted online or by phone are called Card Not Present (CNP) transactions. Online CNP transactions involve credit card gateways that transmit payments from merchants to their payment processors.

Following is a list of recommended attributes of payment gateways that address the unique requirements of the collection industry:

Many debt collection companies need multiple merchant accounts to support their diversified array of training programs. Gateways should ideally be able to manage multiple merchant I.D.s organized under one master MID relationship.

Payment gateways need to seamlessly integrate into CRMs, POS systems, third-party software, and eCommerce shopping carts to facilitate all forms of online, MOTO and in-store commerce.

Professional debt collectors rely on a variety of real-time reports and transaction data to grow and scale their businesses and manage chargebacks and refunds.

In addition to enhanced reporting, debt collection merchants need to securely access transaction data from anywhere they happen to be working, with built-in permission levels that facilitate all levels of employees and management.

Payment gateways must comply with the Payment Card Industry Data Security Standard (PCI DSS). Ask your gateway provider if they are PCI DSS compliant and verify their certificate annually. Debt Collection merchants also need a gateway with a data vault for tokenization of credit card numbers and encryption of customer personally identifiable information (PII).

Tokenization replaces a Primary Account Number (PAN) with a randomly generated set of numbers and records this in the data vault. This is to prevent hackers from accessing customer data. By storing PII and PAN in a highly secure, offsite location merchants shift their liability to the gateway provider. Encryption and tokenization keep your customer’s information safe while allowing merchants access to the data for future transactions.

TranZlytics Gateway:

Choosing the right gateway provider is critical for high-risk merchants and their processors. DigiPay’s chosen gateway is TranZlytics. TranZlytics offers high risk merchants a Gateway and HUB built from the ground up for high-risk and CNP merchants. The solution includes transaction analytics and fraud prevention and built-in advanced chargeback management.

TranZlytics also offers advanced real-time reporting for faster and better use of CRM data.

Payment descriptors are registered with a Chargeback Alerts program; re-presentments are pre-integrated with the gateway.

With a single HUB for transaction management and an expert risk management team to monitor your data, you can focus on what you do best, growing your business. Think of Tranzlytics as a Collection Payment HUB with the IQ of Einstein and the memory of an elephant.

Customer Relations Management (CRM) software is a basic requirement, both for large enterprises and small companies that want to scale and grow their businesses. These systems are designed to automate the lifecycle of product offerings and to facilitate payments. As with payment gateways, it is vitally important to validate the CRM is PCI DSS compliant if it is touching customer information. Unlike payment gateways, CRMs are not rigorously monitored for PCI DSS compliance; a security breach can devastate your business and erode customer trust.

Below are examples of CRMs used by professional debt collection entrepreneurs and enterprise-level service providers:

Designed for debt consolidation professionals, this subscription service CRM can be a cost-effective tool for start-ups and entrepreneurs. The SaaS platform uses a simple, secure and intuitive web interface, requiring no installation and minimal set-up.

This industry-specific CRM platform is configured and designed to serve debt consolidation companies. It includes tools designed to manage leads and recurring billing, improve conversion rates and generate automated email billing and marketing communications.

Zoho, a generic and inexpensive CRM program provides tools for recurring billing, customer tracking, customer satisfaction emails and a customizable database. While the service is not specifically designed for the debt collection industry, it is affordable and supports multiple MIDs.

Google Sheets is a free service that provides a basic spreadsheet for start-ups. Its biggest asset is that it is free.

Debt collection is a highly competitive and rapidly expanding market, and DigiPay is excited to be part of it. Our extended family of collection service provider merchants, with vastly different models and product sets, are equally committed to optimal results, performance metrics and profitability. Some offer short-duration programs; others provide ongoing repayment plans. All want affordable and easy high-risk payment card processing, which is our specialty.

Mike Ackerman

Co-Founder, CEO, DigiPay Solutions

The Association of Credit and Collection Professionals (ACA): ACA International, founded in 1939 and based in Minneapolis, Minn., is a trade association for the credit and collection industry. The non-profit organization represents more than 230,000 industry employees and produces a variety of products, services and publications, articulating the industry’s value to businesses, policymakers and consumers.

The International Association of Commercial Collectors (IACC): The International Association of Commercial Collectors, Inc. (IACC), based in Minneapolis, Minn., is an international trade association consisting of 300 commercial collection agencies, attorneys, law lists and vendors. With members throughout the United States and in 25 countries, IACC contributes to its members’ growth and profitability by delivering essential resources and services in a collaborative, participatory environment.

The New York State Collectors Association (NYSCA): is comprised of 166 New York State Collection Agencies and Collection Professionals. Members work with debtors/consumers on behalf of corporate clients to collect past due receivables. The association’s diversified client portfolio includes healthcare, legal, educational and financial institutions, debt buyers, and other large and small businesses that extend credit or hold past due receivables.

Annual conferences and events provide debt collection professionals with networking and educational opportunities. Here are some examples:

Sept. 17-19, 2017: Northeast Debt Collection Expo: Held at Caesar’s on the Boardwalk in Atlantic City, The Northeast Debt Collection Expo, hosted by the New York State Collectors Association, will cover topics of interest for attendees and vendors. http://www.nyscollect.org/events.html

July 2018: ACA International Convention & Expo: The collection industry’s premier event includes keynote presentations by industry leaders, regulatory updates, emerging legal trends and a large exhibition of leading technology solutions. Other ACA conferences include the ACA Spring Forum & Expo, which covers core curricula required for Credit and Compliance Officer (CCCO) designation; and ACA Fall Forum & Expo which provides educational sessions on compliance certifications and industry trends.

Thank you for taking the time to review this compendium to learn about available opportunities and solutions in the debt collection industry. We look forward to welcoming you to our growing merchant community.

Our online application takes minutes to complete. Once approved, our relationship managers will help you personalize your business management portal and leverage our full complement of secure payment gateway and chargeback management tools. They’ll help provision your processing account, eCommerce website and POS systems in brick-and-mortar stores.

DigiPay will also make it easy for your customers to find you, by helping you create an engaging online and in-store presence and seamless customer checkout experience. Take your debt collection business to the next level today at digipayinc.com